Pakistan - Global Adult Tobacco Survey 2014

The Global Adult Tobacco Survey (GATS) is the global standard to systematically monitor adult tobacco use and track key tobacco control indicators. GATS is a nationally representative household survey of adults 15 years of age or older, using a standard protocol. It is intended to generate comparable data within and across countries. GATS enhances countries' capacity to design, implement and evaluate tobacco control interventions.

Pakistan : Overview of Tobacco Use, Tobacco Control Legislation, and Taxation (English)

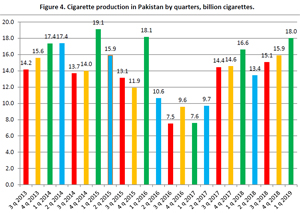

In 2013, Pakistan adopted a new tobacco taxation policy with two specific excise tiers. Then the excise rates were regularly increased in 2014-2016. Cigarette prices increased and, despite the substantial reduction of tobacco affordability, cigarette production almost did not change. Total revenue increased by 50% in nominal terms, or by 30% in real terms in three years.

Economics of Tobacco Taxation and Consumption in Pakistan

Tobacco taxation is a major concern of health and tax policies in Pakistan. Although the tobacco industry thrives on 22 million active tobacco consumers and 100,000 premature deaths in Pakistan, it is still attractive because of a tax tag worth USD 1 billion. Nevertheless, tobacco taxation has largely been an under-researched area; thus, evidence-based policy making is lacking. This report presents an economic analysis of tobacco taxation and consumption in Pakistan and provides three distinct but interconnected analyses based on research conducted by the Pakistan Institute of Development Economics (PIDE).

Pakistan Country Report

This report provides a glimpse of the tobacco landscape in Pakistan. Despite bans in recent years, there are still 24 million users of smoked and smokeless tobacco in Pakistan. Given the high levels of tobacco use, the country faces considerable health and economic consequences.

Large cigarette tax hikes, illicit producers, and organized crime: Lessons from Pakistan

With the stated aim of increasing revenue and discouraging smoking, Pakistan raised tobacco duties over the past five years. The result empowered illicit actors, with a flourishing of illicit production and smuggling of cigarettes.