Public Health Practitioners' Knowledge towards Nicotine and Other Cigarette Components on Various Human Diseases in Pakistan: A Contribution to Smoking Cessation Policies

Smoking cessation seems to be a weak link in the struggle against tobacco epidemic in Pakistan. Awareness regarding nicotine is lacking not only in the general population but also among public health practitioners. This lack of knowledge is one of the key barriers to bringing down the prevalence of smoking. Using primary survey data and nonparametric econometric techniques, this study assesses the knowledge of nicotine and harm reduction among public health practitioners in Pakistan. Results indicate physicians have misconceptions about nicotine. The majority of the medical professionals associate nicotine use with birth defects, cancer, cardiovascular illness, and chronic obstructive pulmonary disease (COPD).

How Media Stories in Low- and Middle-Income Countries (LMICs) Discussed the US Food and Drug Administration's (FDA's) Modified Risk Tobacco Product (MRTP) Order for IQOS

In 2020, the US FDA authorized the marketing of IQOS as a modified risk tobacco product (MRTP) with reduced exposure information (reduces exposure to harmful chemicals compared to cigarettes) but prohibited Philip Morris International from making reduced risk claims (reduces risk of disease compared to cigarettes). We aimed to assess how news media in low- and middle-income countries (LMICs) discussed this authorization and whether articles discussed IQOS as a reduced exposure versus reduced risk product.

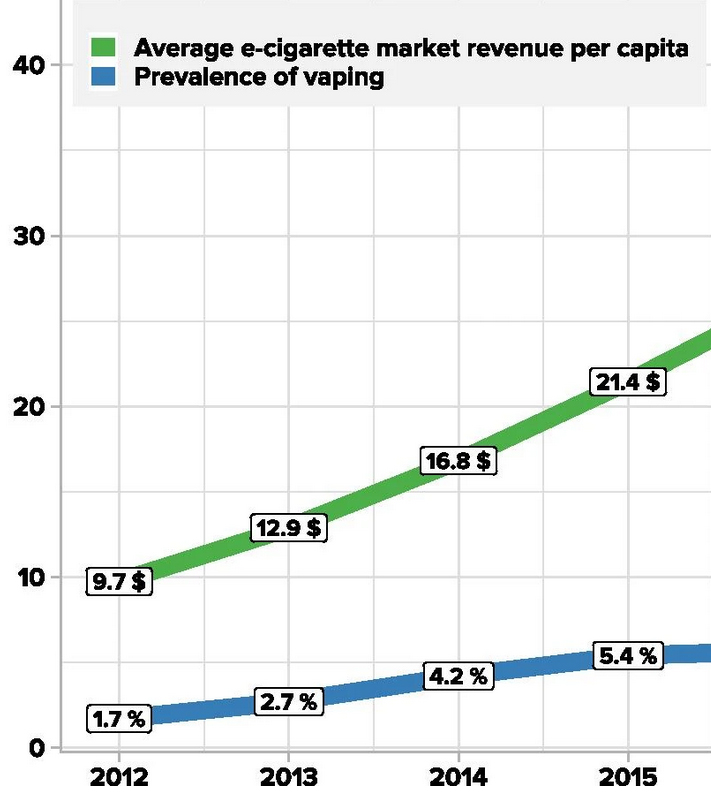

Diverse e-cigarette regulations in the Asia Pacific: A health economic perspective

E-cigarettes or vaping devices are battery devices that aerosolise a liquid for inhalation. The liquids used in e-cigarettes vary and contain a range of flavouring chemicals, solvents and many contain nicotine. They have been enthusiastically marketed via social media as reduced harm products to help people quit cigarette smoking and uptake has been rapid with an estimated 86 million e-cigarette users globally.

Promotion of E-Cigarettes on TikTok and Regulatory Considerations

E-cigarettes are promoted extensively on TikTok and other social media platforms. Platform policies to restrict e-cigarette promotion seem insufficient and are poorly enforced. This paper aims to understand how e-cigarettes are being promoted on TikTok and provide insights into the effectiveness of current TikTok policies.

The 20th anniversary of the WHO Framework Convention on Tobacco Control: hard won progress amid evolving challenges

The 20th anniversary of the WHO Framework Convention on Tobacco Control: hard won progress amid evolving challenges

Device and liquid characteristics used with sweet, menthol/mint, and tobacco ENDS liquid flavors: The population-based VAPER study

Introduction: Electronic nicotine delivery system (ENDS) device and liquid characteristics (e.g., wattage, nicotine concentration) are diverse and important in determining product appeal, aerosol volume/nicotine levels, and toxicity. Little is known about how device and liquid characteristics vary by flavor; we address this gap to identify potential regulatory implications.

Juul settles youth e-cigarette marketing lawsuits

Juul Labs has settled lawsuits filed by six states and the District of Columbia for nearly a half-billion dollars, state attorney generals announced on April 12, 2023. New York, California, Colorado, Illinois, Massachusetts, New Mexico, and Washington DC filed suit over the company's marketing of e-cigarettes to teens starting in 2015. State investigators concluded that Juul executives knew their marketing contributed to skyrocketing youth vaping rates nationwide, reversing years of tobacco control efforts.

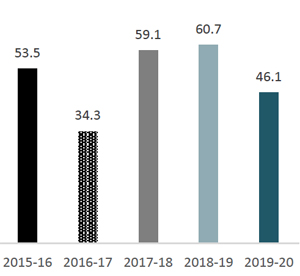

Govt. Kitty Vs Public Health - The Case of Reduction in Prices of Cigarettes in Pakistan

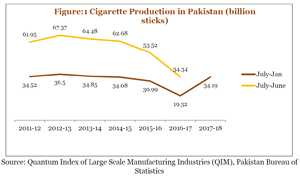

Cigarettes are the most commonly used medium for tobacco consumption. Annual cigarette consumption in Pakistan is around 86.7 billion sticks1 (49 billion in 19972). Annual local production averages above 57 billion sticks.

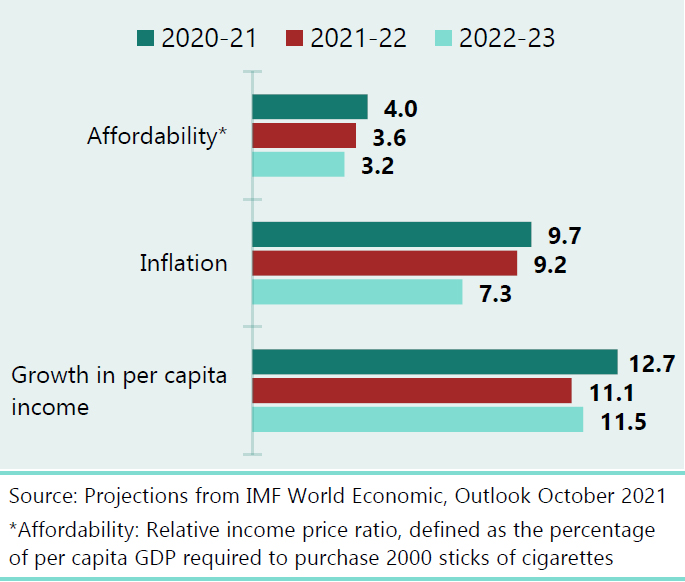

Budget 2022-23: Revenue and Health Implications of Cigarette Tax Policy Options in Pakistan

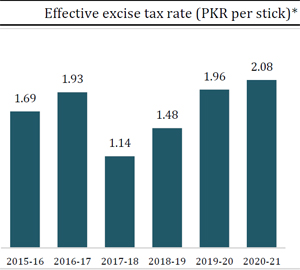

This Policy Note was written by Social Policy and Development Centre in Pakistan. The policy note simulates the impact of the increase in cigarette excise taxation passed in the Finance Act 2022 of Budget 2022-23, as well as an alternative 30% increase in the FED rate. The Finance Act 2022 increases the Federal Excise Duty (FED) rate for low-priced and high-priced cigarettes by 12.1% and 13.5%, respectively, for a weighted average increase of 12.5%.

Role of Tobacco in Pakistan's Economy: An Untold Reality

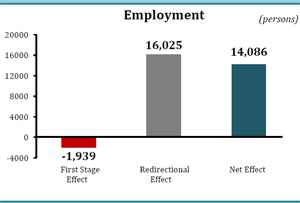

This policy brief is based on a research study by the Social Policy and Development Centre (SPDC), Macroeconomic Impacts of Tobacco Use in Pakistan, which discusses Pakistan's tobacco economy, economic linkages of the cigarette industry, the ripple effect of the industry on output, income, and employment generation, and the short-term losses and long-term gains of a tobacco free economy in Pakistan.

Higher Tobacco Tax, Fewer Cigarettes Consumed

This Policy Brief was written by the Pakistan Institute of Development Economics (PIDE) in Pakistan. The policy brief discusses the impact of tax increases on the behavior of smokers. The authors find that a 50% increase in the price of cigarettes results in almost half of the smokers surveyed quitting. In contrast, only 2.6% respond that they would switch to a different, cheaper cigarette brand.

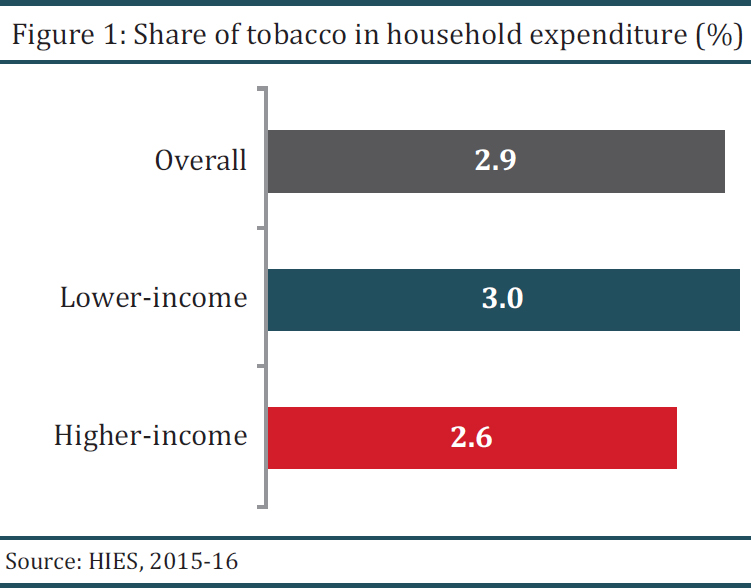

Tobacco Expenditure Leads to Reduced Spending on Basic Needs Among Poor Households

This Policy Brief was written by the Social Policy and Development Centre (SPDC) in Pakistan. The policy brief discusses the impact that tobacco expenditure has on household consumption in Pakistan. The findings complement previous research on the crowding out effect in low- and middle-income countries, which shows that tobacco use results in decreased household spending on other basic needs.

Economic Implications of Cigarette Taxation in Pakistan: An Exploration Through a CGE Model

This Report was written by the Social Policy and Development Centre in Pakistan. The report discusses the macroeconomic and distributional impacts of changes in tobacco use prevalence in response to an increase in tobacco taxes. The researchers use computable general equilibrium (CGE) modeling to estimate the impact on tax revenues, consumption, raw tobacco production, cigarette manufacturing, employment, and the overall economy.

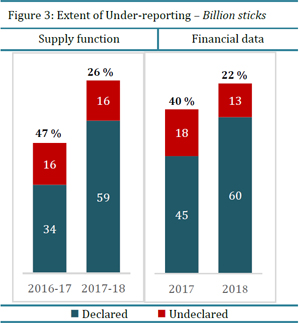

The Untapped Tax Potential of the Cigarette Industry in Pakistan

This policy brief was produced by the Social Policy and Development Centre of Pakistan (SPDC) and estimates the extent of under-reporting of cigarette production by the tobacco industry in recent years. The considerable level of under-reporting substantially effects tax collection efforts by the Federal Board of Revenue. Among other policy recommendations, the brief recommends greater efforts to monitor the industry to prevent further under-reporting.

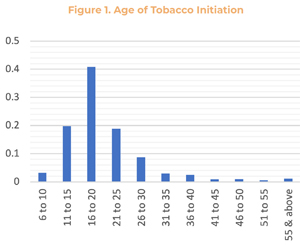

Attitudes of Smokers Towards Tobacco Control Policies: Findings from the Studying Tobacco Users of Pakistan (STOP) Survey

Background: Public attitude is a political driver in successful implementation of tobacco control policies. We assessed support for a range of tobacco control policies among smokers in Pakistan.

Raising Tobacco Tax Rates to Promote Public Health and Increase Revenue: Policy Options for Budget 2022-23

This Fact Sheet was developed by tobacco control partners from Pakistan: Social Policy and Development Centre (SPDC) in collaboration with World Health Organization- Pakistan, Campaign for Tobacco Free Kids, The Union, and Vital Strategies. The fact sheet discusses the large economic and public health burden of tobacco in Pakistan, as well as the current tobacco tax structure. Tobacco taxes in the country are low, with an average excise tax rate of only around 45%.

Research

Reports

Featured Posts

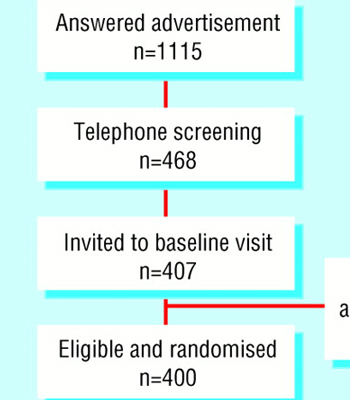

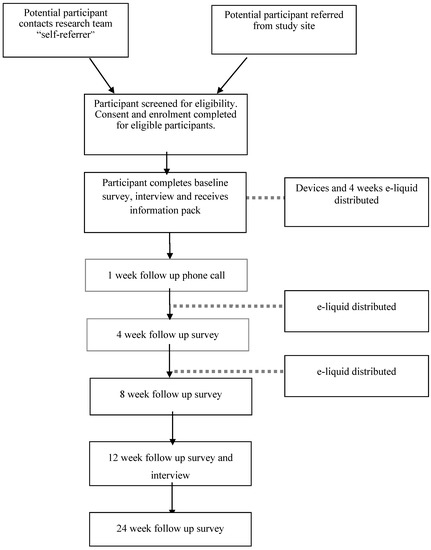

Smoking reduction with oral nicotine inhalers: double blind, randomised clinical trial of efficacy and safety